February 20, 2026

The Comfortable Lie We Tell Ourselves

We are taught, almost from birth, that markets are neutral arbiters of value. The story goes something like this: capital flows to the best ideas, investment rewards productivity, and money gravitates naturally toward wherever value is being created. The market, in this telling, is simply a discovery mechanism — an objective process that reveals what is worth building and who deserves the resources to build it.

It is a reassuring story; it suggests meritocracy and implies fairness. And it is, at its core, backwards.

Capital does not discover value. Capital selects what gets to become valuable in the first place.

This distinction may seem subtle, but its implications are enormous, for individuals, for societies, and increasingly, for the automated systems we are now building to manage capital on our behalf. Understanding it is a prerequisite for building anything better.

Possibility Is Gated by Allocation

Consider two ideas existing simultaneously in the world:

One receives funding.

The other does not.

Which one becomes real? Which one gets to scale, build infrastructure, hire people, iterate, fail safely, and try again?

We tend to look at the winner afterward and say: “See, the market chose the better idea.” But what actually happened is simpler and more troubling: the market chose the funded idea.

One may say that we are operating in a neutral system. Yet, we are operating in a system where possibility is gated by allocation. The question of which ideas, technologies, or communities get to flourish is answered by their access to capital, and access to capital is itself shaped by history, relationships, and existing concentrations of wealth.

This has profound consequences for questions of poverty and inequality — questions that have occupied serious thinkers and policymakers for generations. The driving factors of poverty are, in significant part, a lack of access to the mechanisms by which ideas become real and work becomes wealth. When we pretend that capital is neutral, we obscure this structural reality behind a mythology of individual merit.

The Quiet Mechanism of “Efficiency”

The language of economics offers us another comfortable fiction: efficiency. We say that resources flow toward their highest and best use because people are willing to pay for them. But willingness to pay is simply a reflection of existing wealth. It is not the same thing as who needs something most, who would benefit most from it, or what outcome would be best for the system over the long term.

What “efficiency” actually describes is the ability to economically signal preference, and so efficiency becomes a quiet mechanism by which access to opportunity, access to infrastructure, and access to participation are determined not by what creates the most long-term resilience, innovation, or generational impact but by purchasing power.

And no, this is not a conspiracy. It does not require bad actors, it does not require anyone to consciously choose inequality. Once innovation needs funding, once a protocol needs liquidity, once governance requires token ownership, the system naturally begins to protect asset values, capital flows, and yield-producing structures because stability depends on them. Policy, development, and incentives all start aligning with capital preservation, whether anyone intends it or not.

Neutrality stops being possible.

Intent: The Hidden Variable in Every Deployment

Beneath all of this lies something we rarely discuss explicitly: intent. Capital does not move without it. Every time capital is deployed, someone, or increasingly, something, is making assumptions. They are considering time horizons, risk tolerance, what outcomes matter, and what tradeoffs are acceptable.

Consider the difference between capital deployed toward short-term arbitrage versus long-term public infrastructure. Between speculative assets and cooperative networks. Between private yield optimization and privacy-preserving systems. These choices, made at the moment of deployment, lead to entirely different coordination environments over time.

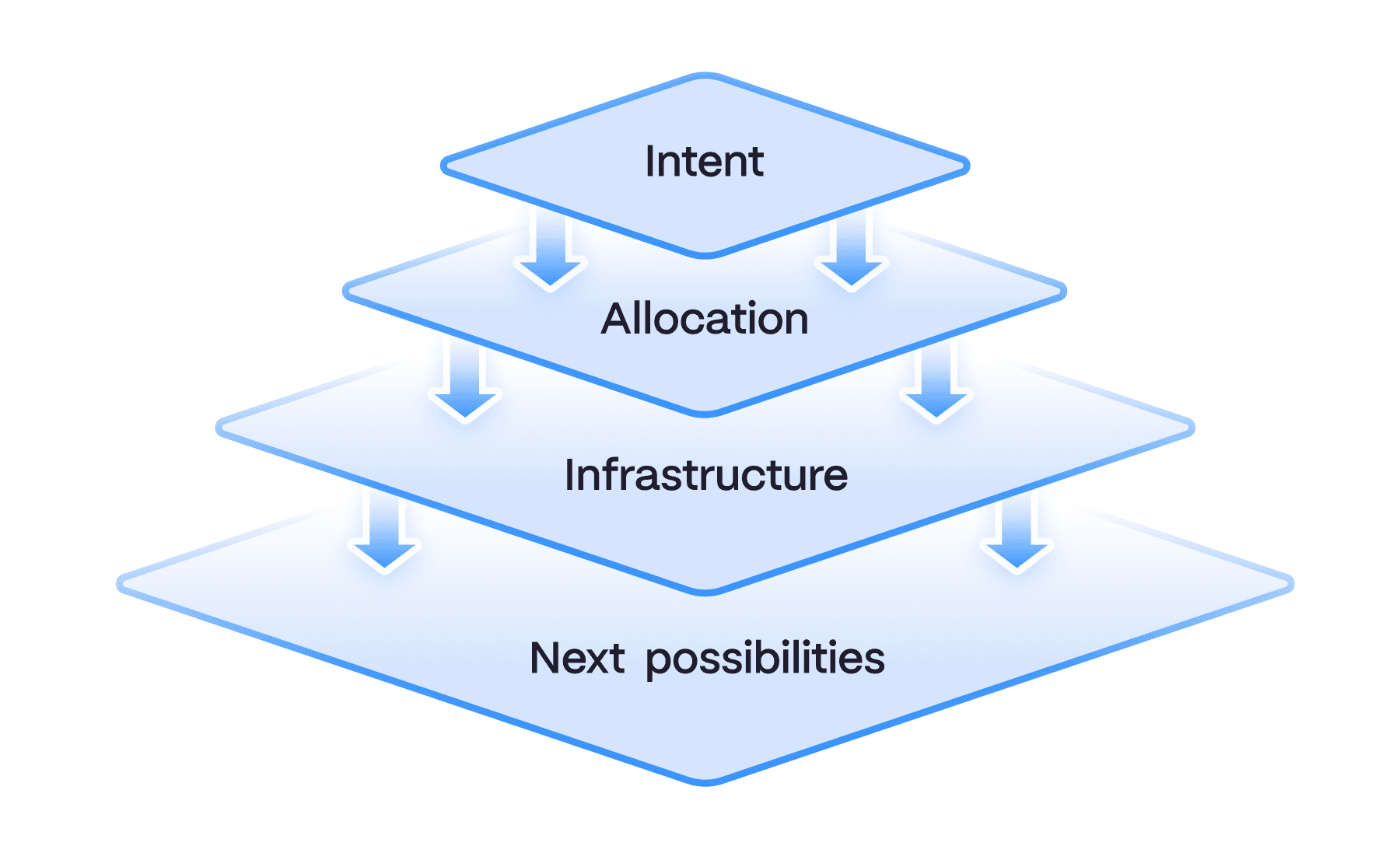

Intent shapes allocation → Allocation shapes infrastructure → Infrastructure shapes what is even possible to build next.

And it is not merely a theoretical observation, but a claim about causality: the decisions we make today about where capital flows are literally constructing the future that will be available to us tomorrow. We are allocating resources and choosing which futures get to exist.

From a deeper perspective, every act of capital deployment is an act of intention made manifest. Every deployment embeds assumptions, values, and priorities into the material world — shaping what gets built, who participates, and what kinds of coordination become possible or impossible downstream.

The Agentic Mirror: When Capital Teaches Itself Where to Go

All of the above has been true for as long as capital has existed, but we are entering a new era — one that transforms these long-standing dynamics into something qualitatively different and potentially far more consequential.

We are building agents.

Software is now allocating liquidity, managing portfolios, executing trades, and voting in governance. These agents are trained on historical data: past allocation decisions, yield optimization strategies, risk-adjusted performance metrics, and the accumulated record of which entities our existing systems have deemed worthy of capital.

They are learning, in other words, from past allocated systems and then reinforcing them.

Past capital decisions are beginning to shape future capital decisions automatically. Allocation has become recursive. Capital is starting to teach itself where to go.

There is a critical compounding problem here that we must confront honestly. A human being has finite time, finite attention, and finite labor output. There are natural limits to how much damage or how much good any individual actor can do. Agents do not have these constraints, they can scale something limitlessly. If we build agentic systems on top of models that are old and antiquated, we will get more old and antiquated capital allocation: faster, more efficiently, and at a scale that no human intervention could easily reverse.

The stakes of this moment are not abstract.

If agents are trained on data that reflects historical patterns of exclusion, bias, and concentration, and if those agents then autonomously compound those patterns at machine speed and scale, we risk encoding our worst capital allocation decisions into an automated system that reinforces them indefinitely.

We have to be extraordinarily careful about what we choose to scale.

The Narrative Machine: Visibility as Power

In digital and tokenized markets, there is another layer to this dynamic: narrative. What gets tokenized, made liquid, made tradeable, and made collateralizable becomes economically visible. What does not might as well not exist in capital terms.

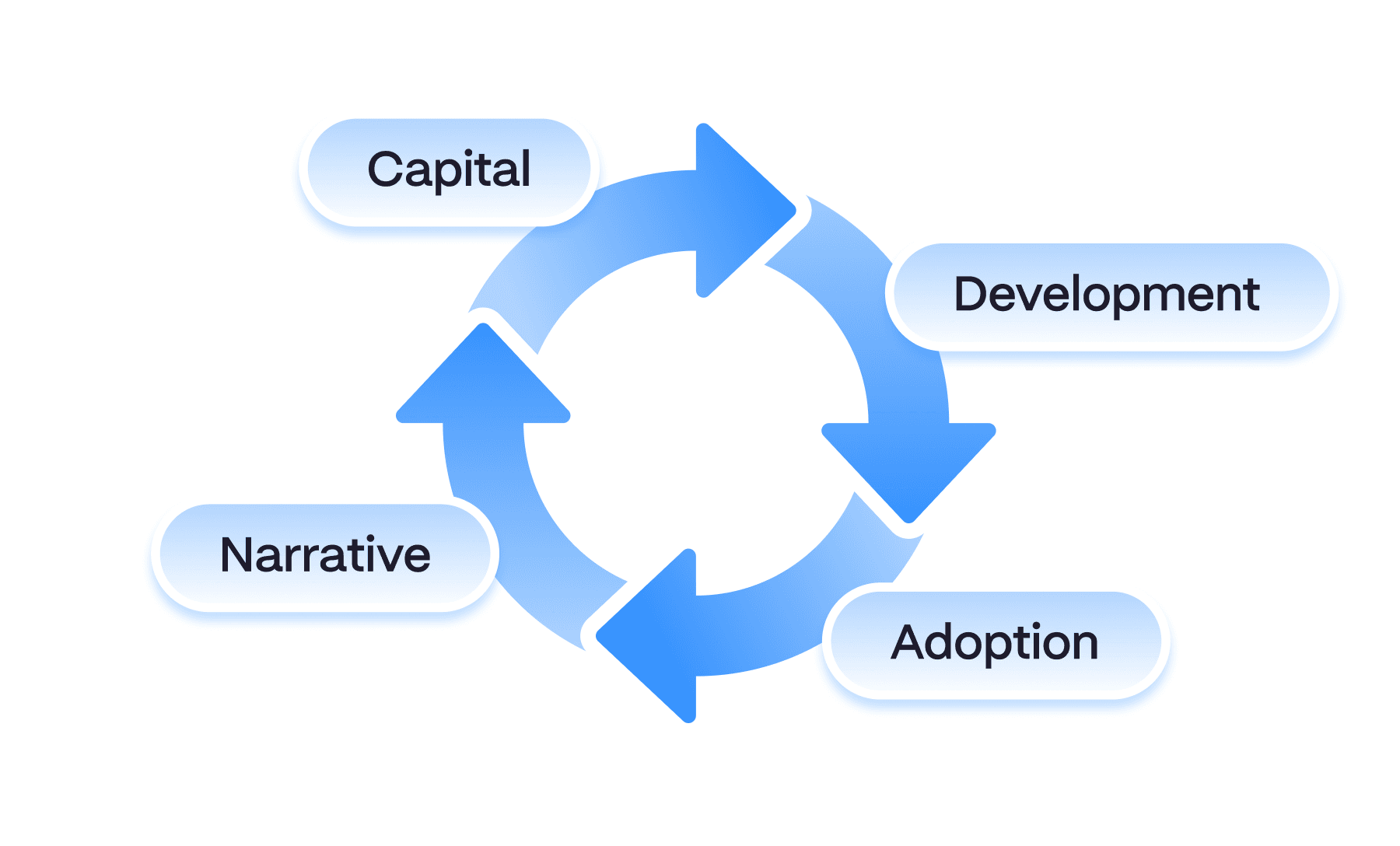

The cycle is self-reinforcing.

Narratives attract capital → Capital funds development → Development creates adoption → Adoption reinforces the narrative.

Around and around it goes.

The result is that a small number of well-positioned projects, backed by the right networks and the right stories, absorb disproportionate attention and resources, while genuinely innovative work that lacks narrative momentum or the right relationships withers unnoticed.

The crypto industry offers particularly clear evidence of this.

Projects with massive venture capital backing have repeatedly imploded because capital flowed based on relationships and narrative rather than genuine capability. The “good old boys club” is not a crypto-specific phenomenon. The same dynamic operates in traditional markets: friends back friends, networks back networks, while competence is a secondary consideration.

And we call it the market.

What AI Does — and Does Not — Know About Us

There is a further complication in our current moment that deserves attention.

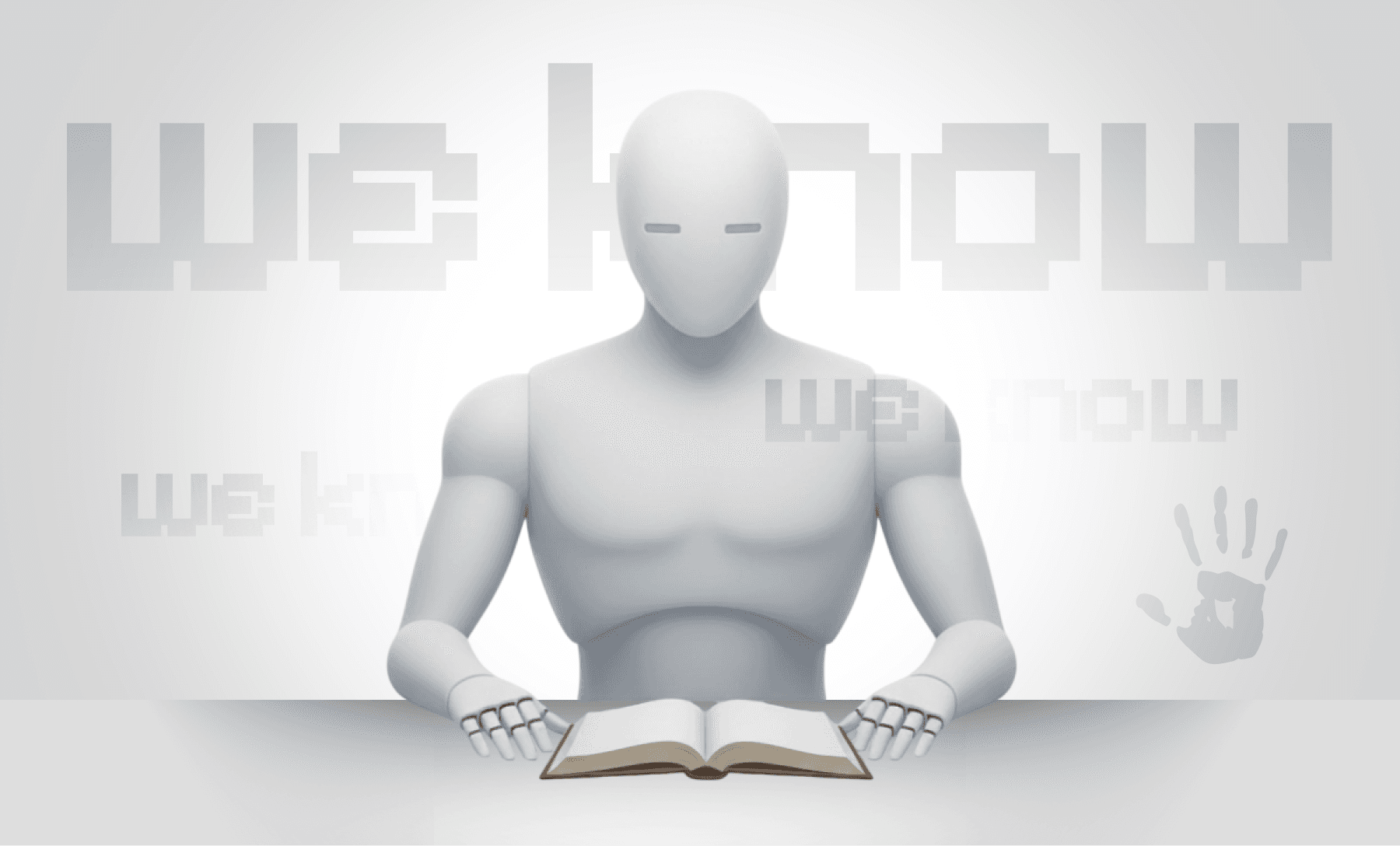

The AI systems we are building to manage capital are trained predominantly on modern-age data: articles, internet content, and digitized texts from recent decades. The ancient wisdom traditions, the great philosophical and spiritual corpora that represent thousands of years of accumulated human insight about value, purpose, and the good life these are largely absent from the datasets on which our capital-managing agents are being trained.

This matters more than it might initially appear. Our most important thinking about what makes a society flourish, what constitutes genuine value, what we owe each other, and how to build systems that serve humanity across generations, much of this lives in precisely the sources that our AI training pipelines are not capturing. We are building the future with agents that know a great deal about the recent past and almost nothing about the deepest wells of human thought.

Markets ≠ Mirrors. Markets = Selection Mechanisms.

At some point, we have to let go of the idea that markets are mirrors of value. They are not. They are selection mechanisms.

They scale some futures.

They starve others.

They stabilize certain coordination systems and quietly prevent alternatives from ever getting off the ground.

In agentic markets, that selection logic can scale automatically, compounding and compounding, without rest, without oversight, without the natural friction that human decision-making introduces. The selection mechanism does not disappear when we automate it. It accelerates.

This is why the transparency argument matters so deeply.

One of the most compelling promises of blockchain technology is the possibility of making capital flows visible, creating conditions under which people can see where resources are actually going and make more informed decisions as a result. If we can make capital flows transparent, if we can make donation and investment decisions auditable on-chain, we create the possibility that capital might flow more efficiently toward the projects and communities that genuinely deserve it.

But transparency alone is not sufficient.

We also need to interrogate the intent embedded in our systems. We need to ask, with rigor and honesty:

Toward what outcomes is this capital being directed?

Under what assumptions?

With what intent?

Who benefits and who is excluded?

What futures are being selected for?

What futures are being foreclosed?

The Real Question We Need to Ask

The question is not whether capital is flowing efficiently. Efficiency, as we have seen, is itself a value-laden term that encodes existing distributions of power. The real question is: toward what outcomes, under what assumptions, with what intent?

These uncomfortable questions require us to examine the incentive and reward structures we have built, to be honest about what we are actually optimizing for, and to resist the temptation to package our existing systems in more palatable language simply because change is hard. They require us to face the agentic mirror, to look at the AI systems we are building and recognize that they are, in a very real sense, the culmination of who we are as a civilization right now: our assumptions, our biases, our priorities, our blind spots.

If we build agents on the foundations of our old and antiquated allocation models, we will get more of what we have. Faster, at a greater scale, and increasingly difficult to reverse. If instead we approach this moment with clarity of intent (with a genuine commitment to building systems that create long-term resilience, that expand access rather than concentrating it, that select for futures in which more people can participate), we have an extraordinary opportunity.

The agentic age is a choice, and the most important thing we can understand about capital (before we hand it over to machines to manage at infinite scale) is that it has never been neutral. It has always been choosing which futures get to exist.

Now, for the first time in history, we have both the tools to make that choice explicit and the stakes high enough that we can no longer afford to pretend otherwise.

Co-authors: Jordan Charters, CEO @EntertheRYFT& Dmitriy Babenko, Co-founder @woof_software

Are you a founder ready to deploy capital with intent and build the systems that decide which futures get to exist?

👉 Contact @woof_software today!