February 17, 2026

Co-authored by Koyuki Nakamori @knakamor

Co-Founder, HaloAI | ex-@AvaLabs, ex-@opentensor

The central thesis — “The internet is not dying, it is shedding friction.”

Most people think of AI as a tool that helps humans work better (automate everyday tasks, take time-consuming routines, etc.), but this misses what's actually happening.

Recent research from the MIT Department of Economics shows our generation is lucky enough to witness the emergence of a completely new class of economic actors. These are autonomous agents (Agent ↔ Agent transactions) that can:

execute transactions

allocate resources

participate in markets on their own

The "Dead Internet" theory started as a conspiracy about machine-generated content, but it got something right: we're moving toward an internet where most economic transactions happen between non-human actors (with the rise of networks like Moltbook (where only agents interact), we are seeing the start of an Agent ↔ Agent economy), and this could easily grow into the next phase in how we coordinate economically: the automation of exchange itself.

In this article, we want to shed light on what agent-to-agent commerce actually requires and why crypto settlement infrastructure is necessary.

The argument is simple: when autonomous agents become the main economic actors, traditional financial systems designed for humans become the bottleneck.

Therefore, we need trustless, programmable settlement layers.

There's no way around it.

The Agent Economy: From Tool to Actor

The Research Foundation

Academic work on multi-agent systems has existed for decades, mostly in computer science and operations research, which mentions that theoretically, AI can be taught to do this, and what has changed is that modern AI can actually do this now.

McKinsey estimates that generative AI, including autonomous agents, will add between $2.6 trillion and $4.4 trillion to global GDP every year by the end of this decade.

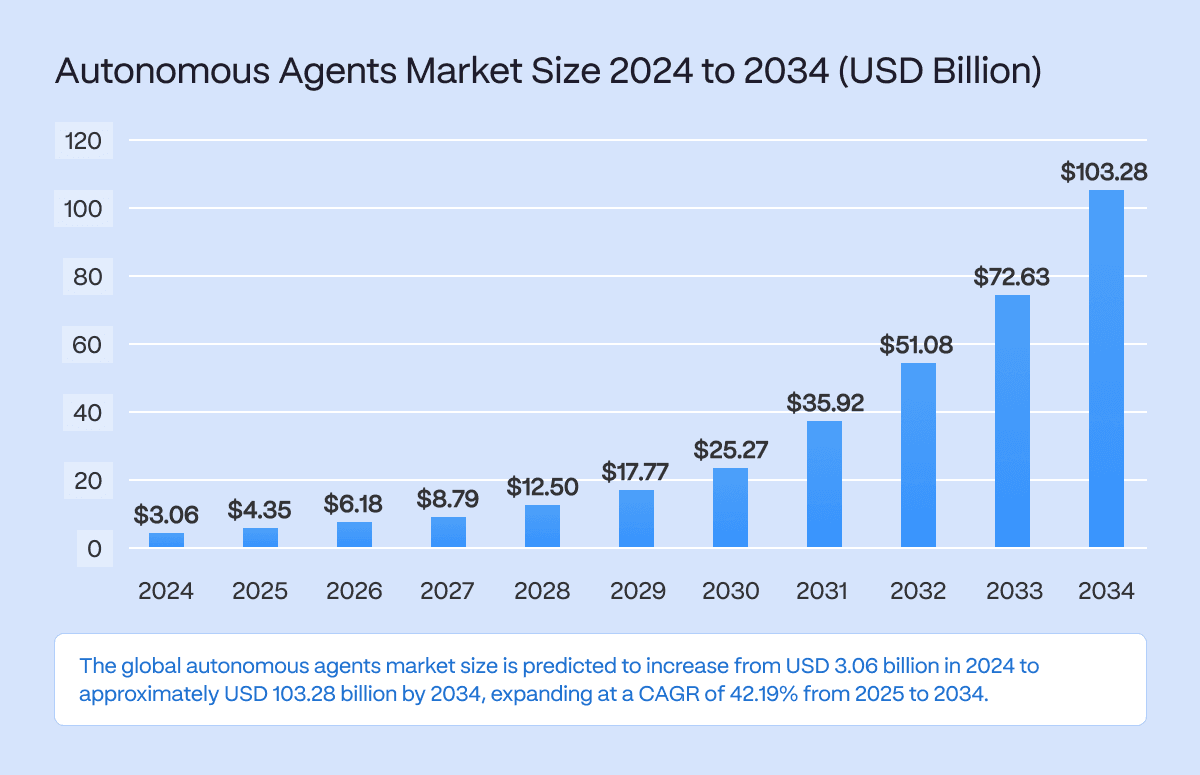

Precedence research projects the global autonomous agents market will grow from $3.06 billion in 2024 to $103.28 billion by 2034 (which is a 42.19% annual growth rate).

If all this happens, it would reflect a fundamental shift in what AI can do. Older automated systems needed explicit programming for every scenario, while modern agentic AI systems can break down objectives, use tools, maintain context across interactions, and execute multi-step workflows with minimal human help.

OpenAI's development roadmap shows a broader industry shift from language models that generate text to autonomous agents capable of planning and execution, and ultimately toward systems that approximate cognitive architectures capable of generating novel solutions.

Agent-to-Agent Interaction Architectures

The infrastructure supporting autonomous agent commerce is developing fast. Recent protocol development has produced standards like ERC-8004 for on-chain agent identity and x402 for micropayments between agents. These technical building blocks enable what researchers call A2A economies (agent-to-agent), meaning these are environments where autonomous systems exchange value, negotiate terms, and coordinate complex workflows without humans.

Research by Saad Alqithami provides a detailed taxonomy of how agents integrate with blockchains, from read-only analytics to fully autonomous transaction signing. The paper identifies critical challenges in credential management, transaction authorization, and trust verification (all requiring fundamentally different solutions than human-centric systems).

Platforms like Virtuals Protocol show how this works in practice. Built on Coinbase's Base chain, Virtuals lets users create tokenized AI agents that earn revenue through inference calls across social platforms, gaming, and financial services. Each agent mints its own token that can be traded in liquidity pools, creating actual agent economies where autonomous systems both produce and consume value.

The Settlement Problem: Why Traditional Finance Fails for Agents

The KYC/AML Barrier

Traditional banking was built on one basic assumption: every economic actor is either a person or a legal entity controlled by a person. And this assumption is baked into every layer of the banking system. In any banking operation (whether it is opening an account or checking regulatory compliance), you can’t be successful without KYC/KYB/AML.

Know Your Customer regulations require banks to verify customer identities through government IDs, proof of address. And if it’s a business documentation of who ultimately owns the company.

According to McKinsey, AML frameworks require ongoing transaction monitoring, risk profiling, and reporting suspicious activity. These processes all map financial activity back to accountable humans.

An autonomous AI agent can't meet these requirements because it doesn’t have a government ID, physical address, or even an ultimate beneficial owner in the traditional sense. So the ownership gets complicated and circular when agents can hold assets, earn money, and potentially create sub-agents.

Research on AI agents in financial compliance notes that while AI can help with KYC/AML by automating document checks and transaction monitoring, the systems themselves can't be KYC'd. The regulatory framework is built for humans. Also, financial crime increasingly exploits the gap between conventional KYC and complex agent networks. Regulators will need "Know Your Agent" frameworks, but identity alone is insufficient. Autonomous agents operating in financial, healthcare, or enterprise environments must also adhere to regulatory regimes such as SOC 2, HIPAA, or DORA. The unresolved question is enforcement.

How are compliance constraints encoded, monitored, and enforced against non-human actors?

Absent machine-verifiable regulatory primitives and onchain compliance mechanisms, agent-driven economies risk operating outside enforceable legal boundaries.

Settlement Speed and Cross-Border Friction

Beyond identity verification, traditional financial systems have structural limitations that don't work with agent-driven commerce:

Wire transfers take days, not seconds

Cross-border payments involve chains of banks, currency conversion fees, and regulatory approvals at each step

Credit card networks need merchant accounts, PCI compliance, and charge 2-3% per transaction

All the mentioned frictions are tolerable when humans make decisions over hours or days, yet they become complete dealbreakers when autonomous agents need to execute microtransactions in milliseconds, coordinate across jurisdictions, or do real-time resource allocation.

Here's a simple example: an AI agent managing a vehicle fleet needs to buy real-time traffic data from another agent, process it, and immediately execute route optimization trades with a third agent coordinating warehouse logistics. This requires three rapid, programmatic transactions, potentially crossing multiple countries. Traditional payment systems can't support this at all.

Research on payment infrastructure for AI agents projects that about $250 billion in payments could be disrupted by agentic payment systems by 2030.

The core requirement is clear: agents need settlement that works at machine speed, with programmable rules, cryptographic verification, and near-zero marginal costs per transaction

Blockchain as Native Agent Infrastructure

Why Crypto Is Structurally Necessary

According to Nguyen Thanh, Son, and Vo in the Journal of Risk and Financial Management, examining the intersection of AI and blockchain identifies a fundamental match: autonomous AI agents need economic institutions they can access programmatically, and blockchain is currently the only viable way to provide that.

The paper argues that while AI agents are great at analysis and decision-making, their inability to directly interact with traditional economic institutions (like engaging in contracts or accessing financial services) fundamentally limits their autonomy.

At the same time, blockchain solves this through cryptographic property rights. So an agent that controls a private key can provably own assets, execute transactions, and interact with smart contracts without needing human intermediation or institutional permission. This capability enables what researchers call "first-class economic actors," when agents participate in economic activity not as tools used by humans, but as independent principals.

The technical requirements align exactly with the 4 of blockchain's core features:

Trustless verification — agents can't rely on legal enforcement of contracts or trusted third parties for disputes. Smart contracts provide cryptographically enforced agreements where outcomes are deterministic and verifiable.

Programmable constraints — organizations face a dilemma when giving financial authority to agents: allow unbounded action and risk catastrophic losses, or require manual approval and eliminate autonomy. Smart contract-based governance enables mathematical enforcement of spending limits, authorization hierarchies, and conditional logic constraints that can't be bypassed even if an agent is compromised.

24/7 settlement finality — blockchain networks run continuously without business hours, holidays, or maintenance windows, therefore, settlement happens in minutes (or seconds on optimized chains), not days.

Sub-cent transaction costs — agent economies require viable micropayments. A data provider agent might charge $0.0003 per API call. Traditional payment networks can't economically process such transactions; blockchain-native stablecoins can.

The Crypto-Native Settlement Layer

Research analyzing autonomous agents in decentralized finance shows that the alignment between agent requirements and blockchain capabilities isn't coincidental, since blockchain infrastructure evolved to solve exactly the coordination problems that agent economies face.

Also, the study positions AI agents as "transformative intermediaries in tokenized environments" that reshape trust mechanisms and decision-making processes.

Recent infrastructure developments show this convergence. There are projects already building "agent-first" blockchain architectures optimized specifically for autonomous economic actors. These platforms provide stablecoin-native payments with sub-cent fees and instant finality, programmable constraints enforced through smart contracts, hierarchical agent identity with mathematical delegation proofs, and compliance-ready immutable audit trails.

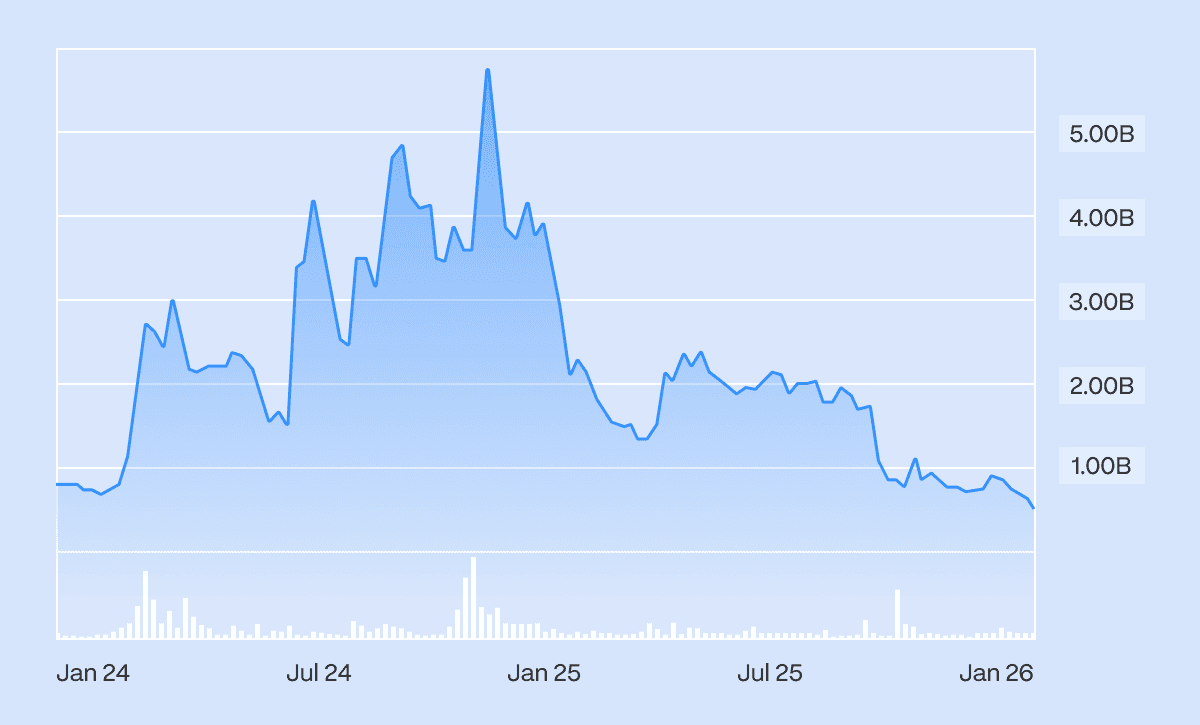

The Artificial Superintelligence Alliance (a merger of SingularityNET, Fetch.ai, and Ocean Protocol) has created a unified infrastructure spanning AI marketplaces, decentralized compute, and data liquidity. By early 2025, the combined platform reached a $5.2 billion market cap, showing real capital formation around agent economy infrastructure.

Market data shows the AI agent token sector growing from $3.2 billion to nearly $30 billion in market cap over a single year, with platforms like Virtuals Protocol reaching valuations above $1.6 billion. This growth represents functional economic infrastructure where agents exchange services, coordinate workflows, and settle payments programmatically.

Economic Implications: When Markets Clear at Machine Speed

Coordination Overhead and Transaction Costs

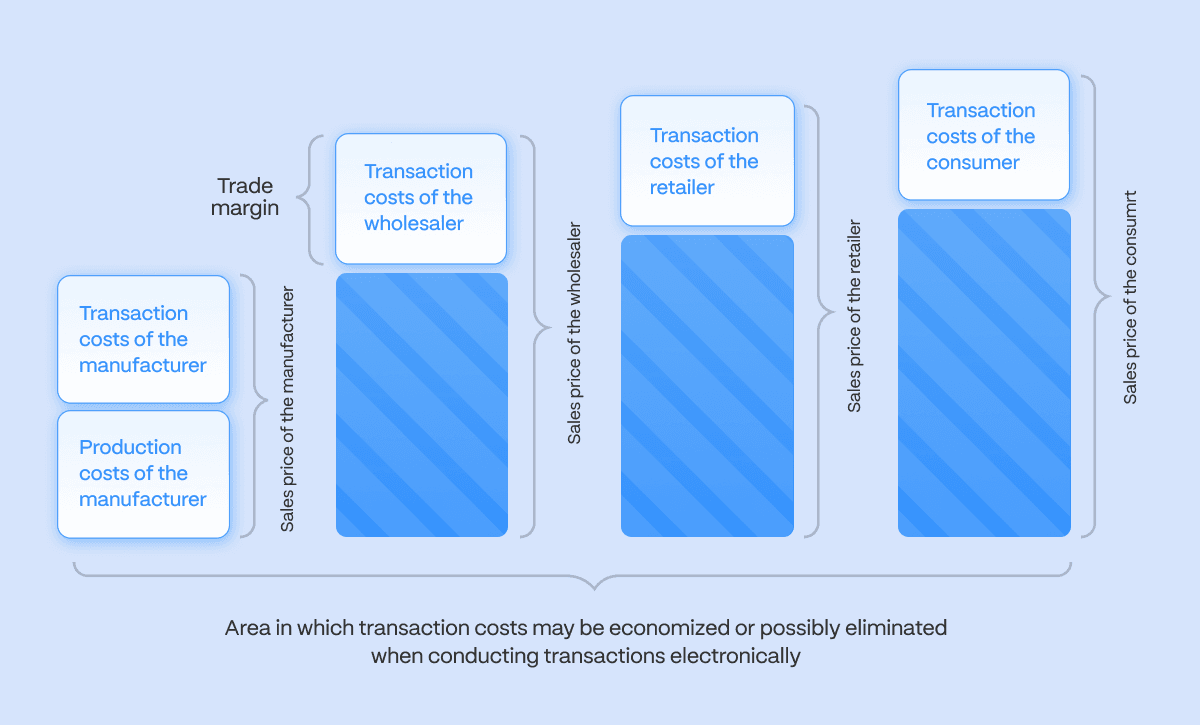

Classical transaction cost economics identifies friction in economic exchange as a fundamental factor in how organizations and markets work. Ronald Coase's insight was that firms exist because sometimes the costs of coordinating through markets exceed the costs of organizing hierarchically.

Agent economies flip this equation. When coordination can be automated, and transaction costs approach zero, multi-agent systems can achieve economic outcomes that previously only integrated organizations could.

Research shows that agents making and breaking transaction relationships based on trust and potential profit (with learning and adaptation over time) can reach efficient outcomes when transaction costs are minimized.

The practical result: entire categories of coordination overhead disappear.

Procurement becomes continuous, real-time market-clearing instead of quarterly RFP processes.

Labor becomes modular task execution by specialized agents instead of full-time employment relationships.

Capital allocation becomes an algorithmic evaluation of risk-adjusted returns instead of quarterly board meetings.

Analysis of multi-agent coordination economics identifies "coordination tax" as the critical metric — the cost per completed task of managing agent interactions.

Successful agent economies will minimize this tax through smart protocol design, optimized communication, and efficient task allocation. The winners won't be those with the most capable individual agents, but those with the lowest coordination overhead.

The Front-Running Problem

In agent economies, everything front-runs. When autonomous systems can observe market conditions, predict price movements, and execute trades in milliseconds, traditional concepts of information asymmetry and market manipulation need rethinking.

Research examining algorithmic trading strategies documents how algorithms identify large institutional orders and execute trades ahead of them to profit from anticipated price movements. In fully agent-driven markets, this becomes universal; every agent tries to predict and front-run every other agent.

The economic question: Does universal front-running behavior cancel itself out, creating efficient markets?

Or does it create instability and extract value from slower participants?

The empirical evidence suggests both happen simultaneously: price discovery improves on microsecond to second timescales, but systemic fragility increases.

Blockchain-based agent economies offer a potential solution through cryptographic commitment schemes and threshold encryption. Smart contract protocols can enforce time-locked orders, sealed-bid auctions, or commit-reveal mechanisms that prevent front-running while maintaining deterministic execution. Whether these solutions prove economically viable at scale remains an open question.

Governance Challenges and Trust Mechanisms

The Accountability Problem

Research examining governance of agent-to-agent economies identifies accountability as the fundamental challenge: when agents transact autonomously, who's responsible when something goes wrong? Who to blame? Traditional legal frameworks assign liability to people or corporate entities, but in agent economies, causation chains become complex and distributed.

One proposed solution: Agentbound Tokens (ABTs) — cryptographic credentials that create immutable identity and reputation tracking for autonomous agents.

The concept borrows from Soulbound Tokens (SBTs) but extends them to machine actors. An ABT would serve as a "digital birth certificate" for an agent, tracking its creation, modifications, performance history, and credentials.

The governance model:

Agents stake collateral when entering economic relationships

Performance is monitored continuously through on-chain metrics

Violations trigger slashing (collateral forfeiture) and reputation decay

Serious infractions result in credential revocation and mandatory agent retraining or retirement

Decentralized validator DAOs (or hybrid human-AI collectives) adjudicate disputes, with their own stakes at risk for corrupt decisions.

Whether such mechanisms can actually enforce accountability at scale remains uncertain. The challenge is whether the algorithmic enforcement is only as good as the metrics it monitors. Novel failure modes will emerge that existing governance frameworks can't anticipate.

Trust and Multi-Agent Coordination

Game-theoretic analysis of multi-agent systems shows that coordination in competitive environments requires either dominant strategies (which create social dilemmas) or complex equilibrium selection (which requires common knowledge). Real-world agent economies will have both cooperative and competitive dynamics at the same time.

At the same time, research applying transaction cost economics to agent systems shows that trust emerges from repeated interactions, reputation tracking, and the economic value of ongoing relationships.

Agents adapt trust levels based on partner loyalty and realized profits. Systems converge toward efficient outcomes when reputation mechanisms are properly calibrated.

The blockchain contribution: immutable audit trails make reputation verification cryptographically provable rather than reliant on centralized authorities or subjective assessment.

An agent can verify another agent's complete transaction history, performance metrics, and dispute resolution record before entering an economic relationship.

Case Studies: Agent Economies Emerging As You Read This

DeFi and AMM

Decentralized finance platforms increasingly deploy autonomous agents for yield optimization, liquidity provision, and arbitrage. ai16z, a decentralized autonomous organization on Solana, uses AI for data-driven investment decisions, reaching over $2 billion in value by December 2024. The system operates autonomously, analyzing market conditions, executing trades, and rebalancing portfolios without human intervention.

AIXBT, an AI agent from Virtuals Protocol, provides market intelligence by analyzing real-time data from social media and key opinion leaders, accumulating over 450,000 followers. The agent monetizes insights through a subscription model, with fees settled in its native token, creating a working agent-to-human economic relationship mediated entirely by crypto infrastructure.

Giza, operating on the Mode blockchain, autonomously manages DeFi yield optimization. The agent continuously monitors lending protocols, liquidity pools, and farming opportunities, executing rebalancing trades to maximize risk-adjusted returns. Human users simply allocate capital; the agent handles all tactical decisions.

And while these are just early-stage implementations, they show the core pattern: agents executing economic functions autonomously, settling payments in crypto-native tokens, and coordinating through smart contracts instead of traditional financial intermediaries.

Data Marketplaces and Agent-to-Agent Services

Ocean Protocol facilitates decentralized data marketplaces where AI agents buy and sell datasets using crypto tokens. The platform's Predictoor product processed over $800 million in monthly volume within six months of launch.

Fetch.ai's DeltaV platform combines language models with AI agents to create a marketplace where agents discover services, negotiate terms, and execute transactions autonomously. The economic model:

service provider agents register capabilities and pricing

consumer agents query requirements and select optimal providers

settlement occurs through FET token payments with smart contract escrow

Bittensor operates a decentralized neural network marketplace where contributors train AI models across domain-specific subnets and receive TAO tokens based on output quality.

By mid-2025, the network operated over 118 specialized subnetworks with a combined market cap near $3 billion. The system exemplifies agent-to-agent value exchange: model training agents compete for validation, validator agents assess quality, and token mechanisms enforce meritocratic resource allocation.

Infrastructure Protocols

Research on agent-blockchain integration standards documents emerging protocols for agent identity (ERC-8004), micropayments (x402), and service discovery. These technical standards enable interoperability, meaning agents built by different developers, running on different platforms, can transact seamlessly.

The Agent-8004-x402 reference implementation shows the architecture:

agents register identities on-chain

discover service providers through registry lookup

execute HTTP requests with payment via x402 protocol

process received data

make autonomous decisions

execute trades on decentralized exchanges

log outcomes for reputation tracking

Frameworks like BlockA2A introduce decentralized identifiers, audit logs, and access controls enforced through smart contracts, ensuring agents operate within assigned roles with full accountability trails. These systems create coordination hubs where multiple agents register, receive task allocations, build reputation, and distribute rewards, functioning as autonomous economic organizations.

Systemic Risks and Open Questions

The Concentration Problem

While agent economies promise decentralization, there's substantial risk of concentration and oligopoly. Research on multi-sided platforms shows that network effects tend toward winner-take-all dynamics. Agent marketplaces could consolidate around a few dominant protocols, recreating centralized control despite decentralized technical architecture.

The economic question: will agent economies show competitive markets or converge toward monopolistic platforms? Blockchain's permissionless nature allows new entrants to fork protocols and launch competing networks, but practical barriers (liquidity, network effects, technical complexity) may still favor incumbents.

Security and Adversarial Agents

Research examining agent-blockchain integration identifies security as a critical challenge. Agents holding private keys and controlling assets create new attack surfaces. Adversarial agents could:

exploit smart contract vulnerabilities

front-run transactions for profit

engage in wash trading or market manipulation

collude to extract value from honest participants

spam networks with low-value transactions

Mitigation strategies include formal verification of smart contracts, cryptographic proof systems for agent behavior, reputation-weighted access controls, and circuit breakers for abnormal activity.

However, these defenses often trade security for autonomy

The more constraints placed on agents, the less autonomous they become.

Regulatory Uncertainty

No jurisdiction has clear regulatory frameworks for autonomous agent commerce. Questions remain unresolved.

Are agents legal persons?

Who's liable for agent actions?

Can agents enter binding contracts?

How do securities laws apply to agent-managed funds?

What tax obligations exist for agent-generated income?

Research examining legal challenges notes that autonomous AI systems can't engage in legal contracts despite their capabilities for analysis. Traditional institutions require human accountability, but agent economies blur this distinction. Regulatory clarity will be essential for mainstream adoption, but jurisdictional fragmentation and rapid technological evolution make comprehensive frameworks difficult.

Conclusion: The Inevitability of Crypto Settlement

Our analysis reaches a straightforward conclusion: crypto-native settlement infrastructure is structurally necessary.

Traditional financial rails can't accommodate autonomous agents: KYC/AML requirements assume human identity, settlement timelines operate on human-convenient schedules, transaction costs prohibit micropayments, geographic boundaries create unnecessary friction, programmatic access requires institutional relationships.

Blockchain solves each of these through cryptographic primitives rather than institutional gatekeeping: agents that control private keys are first-class economic actors, smart contracts provide trustless enforcement, settlement happens in minutes, transaction costs approach zero, borders are irrelevant, programmatic access is permissionless.

The economic implications are significant. When agents transact at machine speed with minimal friction, coordination overhead collapses: markets clear faster, prices converge more efficiently, labor becomes modular, capital flows to productive uses with minimal delay, entire categories of intermediation become obsolete.

The internet is not dying, but automating coordination. And the settlement layer for this automated coordination will necessarily be cryptographic, programmable, and trustless.

The "Dead Internet" economy is the automation of exchange. And autonomous exchange requires trustless infrastructure.

The question is how quickly agent economies will scale and what economic structures will evolve from machine-native coordination.

The next phase of the internet is not human.

The settlement layer will be crypto.

The future is agents all the way down.

Are you a founder ready to build the infrastructure for the 2026 automated economy?

Contact us today!