Problem

Users looking to maximize yield on Compound, particularly with Liquid Staking Tokens (LSTs) like wstETH, often seek to leverage their positions. Currently, achieving this leverage loop (supplying, borrowing, swapping, and supplying again) is a manual, capital-inefficient, and gas-intensive process.

Furthermore, without a native automated solution, Compound risks ceding volume to external wrappers or protocols that offer one-click leverage strategies. Users desire the ability to amplify their exposure to native yields or incentive programs without the complexity of managing multiple transactions or leaving the security of the Compound V3 (Comet) architecture.

Solution

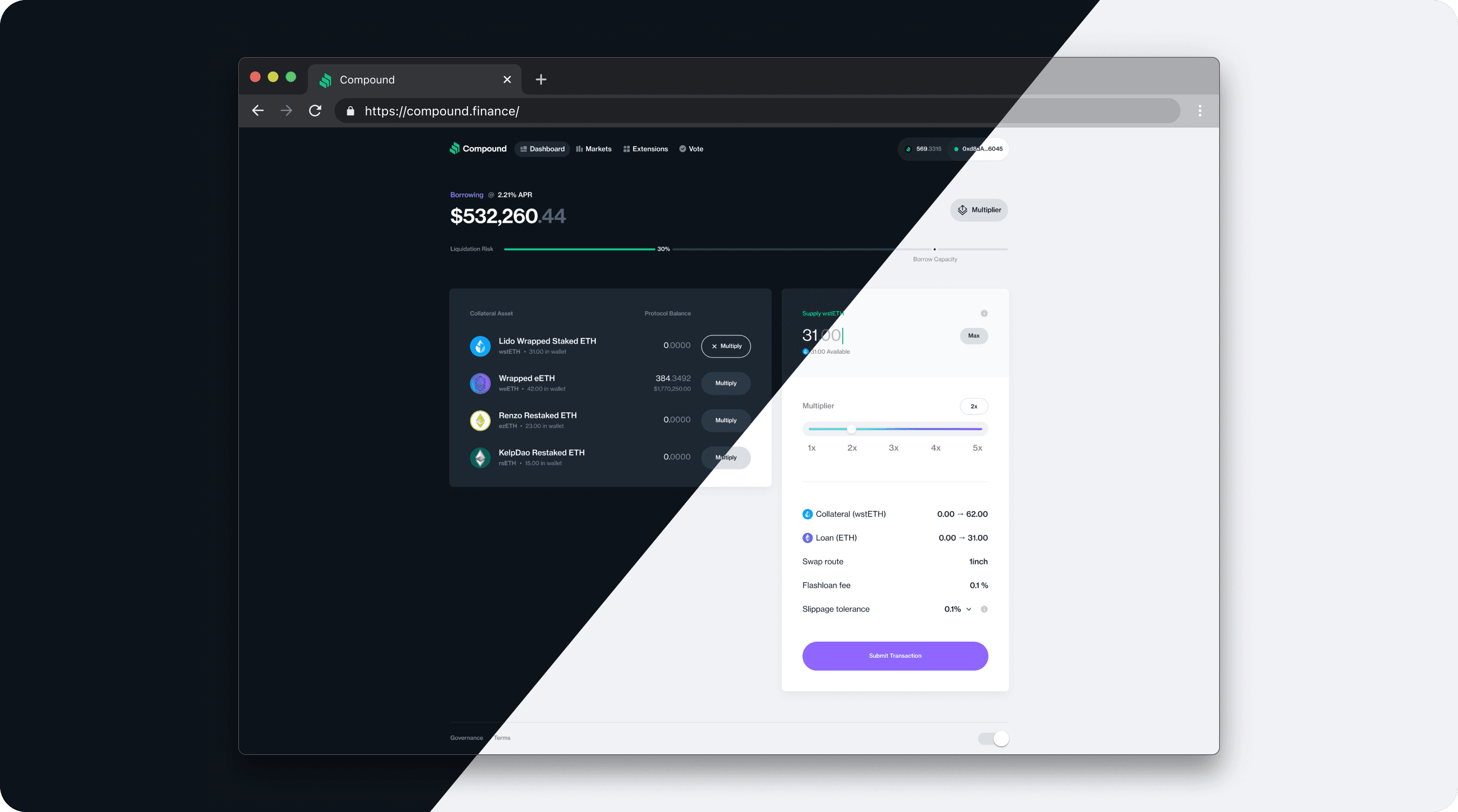

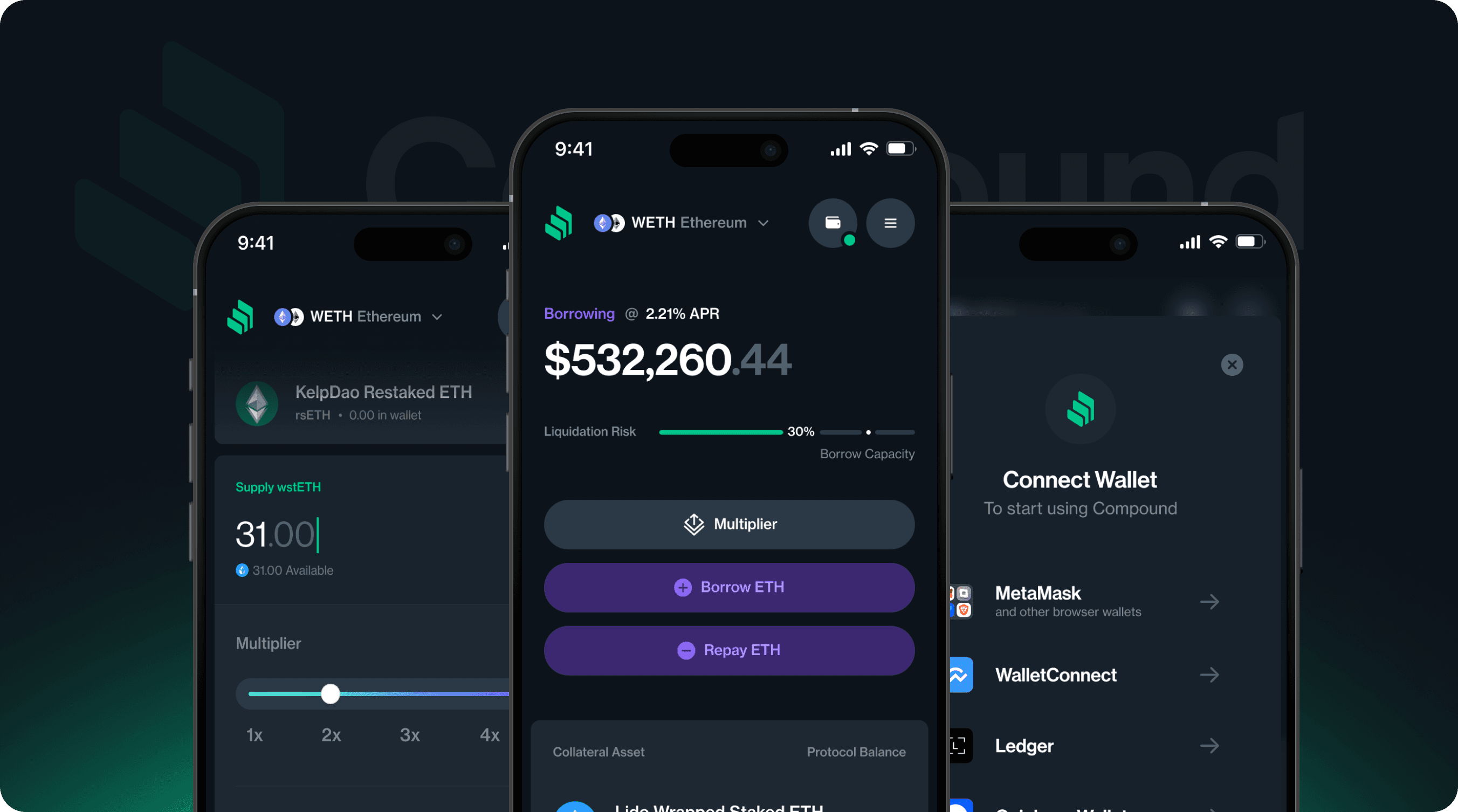

To solve this, we propose the Compound Multiplier, powered by a new SupplyMultiplierAdapter smart contract. This feature adapts the popular multiply mechanism found in integrations like Morpho/Velora directly for Compound.

The Multiplier Mode allows users to seamlessly increase their supplied collateral using borrowed funds in a single atomic transaction. This mechanism enables higher yield exposure and efficient capital usage while ensuring full compatibility with existing Compound V3 markets and UIs.

How it works

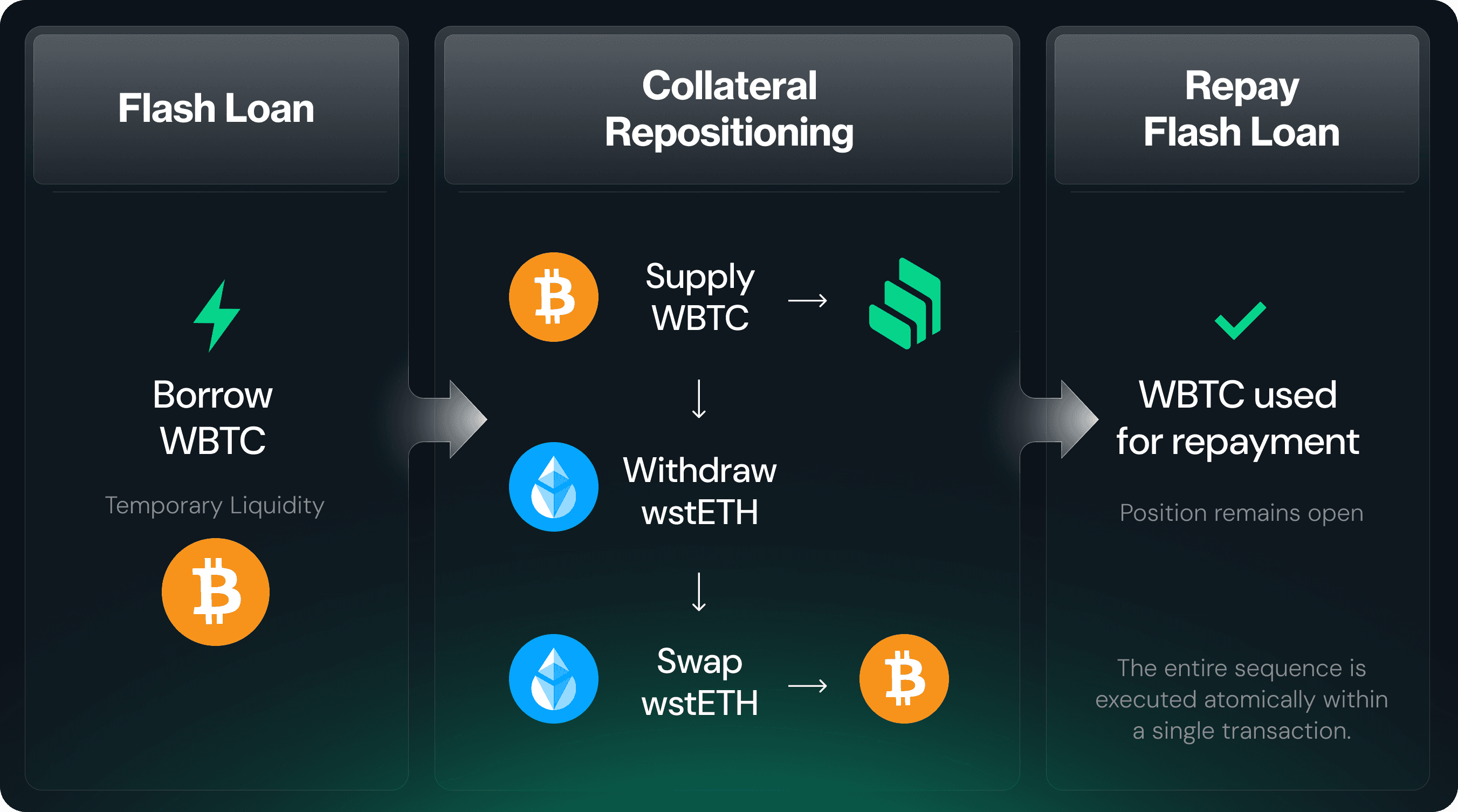

The Supply Multiplier Adapter automates the process of flashloaning and swapping to create a leveraged position.

User Action: The user approves the adapter and specifies the input parameters: Market, Initial Collateral, Target Collateral, and the desired Multiplier (e.g., 3x).

Flashloan & Swap: The adapter accepts the user's initial capital and initiates a flashloan for the base asset. It then swaps this base asset into the target collateral (using protocols like OKX router).

Supply & Borrow: The adapter supplies the total collateral (User's Initial + Swapped Amount) into the Compound market. It then opens a borrow position on behalf of the user to repay the flashloan.

Final State: Any remaining dust is returned to the user.

Example Scenario (3x Multiplier):

Input: User supplies $10 worth of wstETH and gets 7$ debt in WETH.

Execution: The Adapter borrows $20 WETH via flashloan, swaps it to wstETH, and supplies the total. After that the adapter borrows funds up to make it 3x of the initial debt - up to 21$

Result: The user now holds a position with $30 total wstETH collateral and $21 WETH debt. This effectively triples the user's exposure to the staking yield of wstETH, minus the borrowing cost of WETH.

Benefits

Maximized Yields: Users can significantly boost supply-side APY by leveraging native yield-bearing collateral (e.g., wstETH) or maximizing reward token accumulation.

Capital Efficiency: Condenses complex looping strategies into a single, gas-efficient transaction.

Full Compatibility: Built to work within constraints of Comet; user positions remain fully visible and manageable via the standard Compound interface.

Flexible Borrowing: Despite the leverage, users increase their total collateral size, potentially retaining the ability to borrow other base assets against the new, larger position.

Stop losing volume to wrappers, contact our team!

Team behind this project

Stanislav Baraniuk

Lead Front-end Engineer

Bublik

Principal

Olha Bandura

Business Analyst

Philipp Taratuta

Lead Blockchain Architect

Artem Martiukhin

Solidity Developer

Nikita Silkin

Front-end Engineer

Mykyta Tsvietkov

QA Lead

Denis Stoian

Back-end Engineer

Dmytro Orlov

Designer

Pavlo Horbonos

CTO

Mykola Ilchuk

Technical Researcher