Silo Position Migrator: Eliminating Liquidity Traps

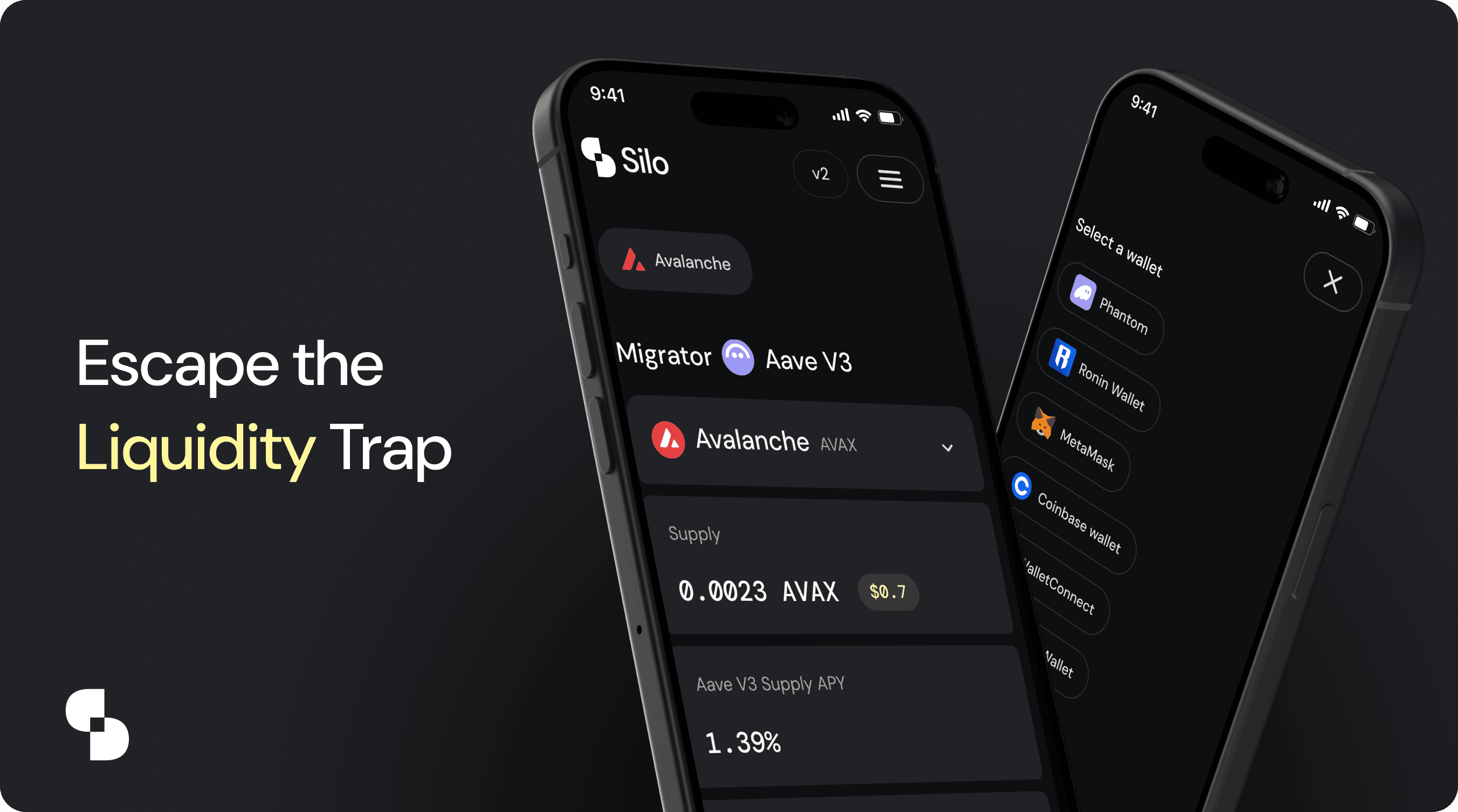

Traditionally, migrating a loan from protocols like Aave or Euler to Silo requires a manual, multi-step process that exposes users to time loss and capital inefficiency. To close a position, users must first possess the liquidity to repay their debt, creating a significant barrier to entry.

Enter the Silo Position Migrator. Powered by advanced Flash Loan architecture and best-price routing, this tool executes the entire migration flow - repaying old debt, withdrawing collateral, and opening a new Silo position, in one atomic transaction. We have eliminated the "liquidity trap," allowing users to seamlessly transport their TVL to Silo without ever needing to hold the underlying debt asset.

The Challenge: Capital Inefficiency

Migrating an active borrow position from one protocol (like Aave or Euler) to Silo is a multi-step, friction-heavy process. Users must manually close debt, withdraw collateral, and then re-establish the position in Silo. This process presents two major problems:

Time & Rate Loss: The process consumes significant time, delaying the user from accessing better APY or more favorable borrowing rates in Silo.

Liquidity Trap: To close the original debt, the user must first obtain the borrowed asset back onto their balance—capital which is usually invested elsewhere. This requirement effectively locks valuable liquidity into competitor protocols.

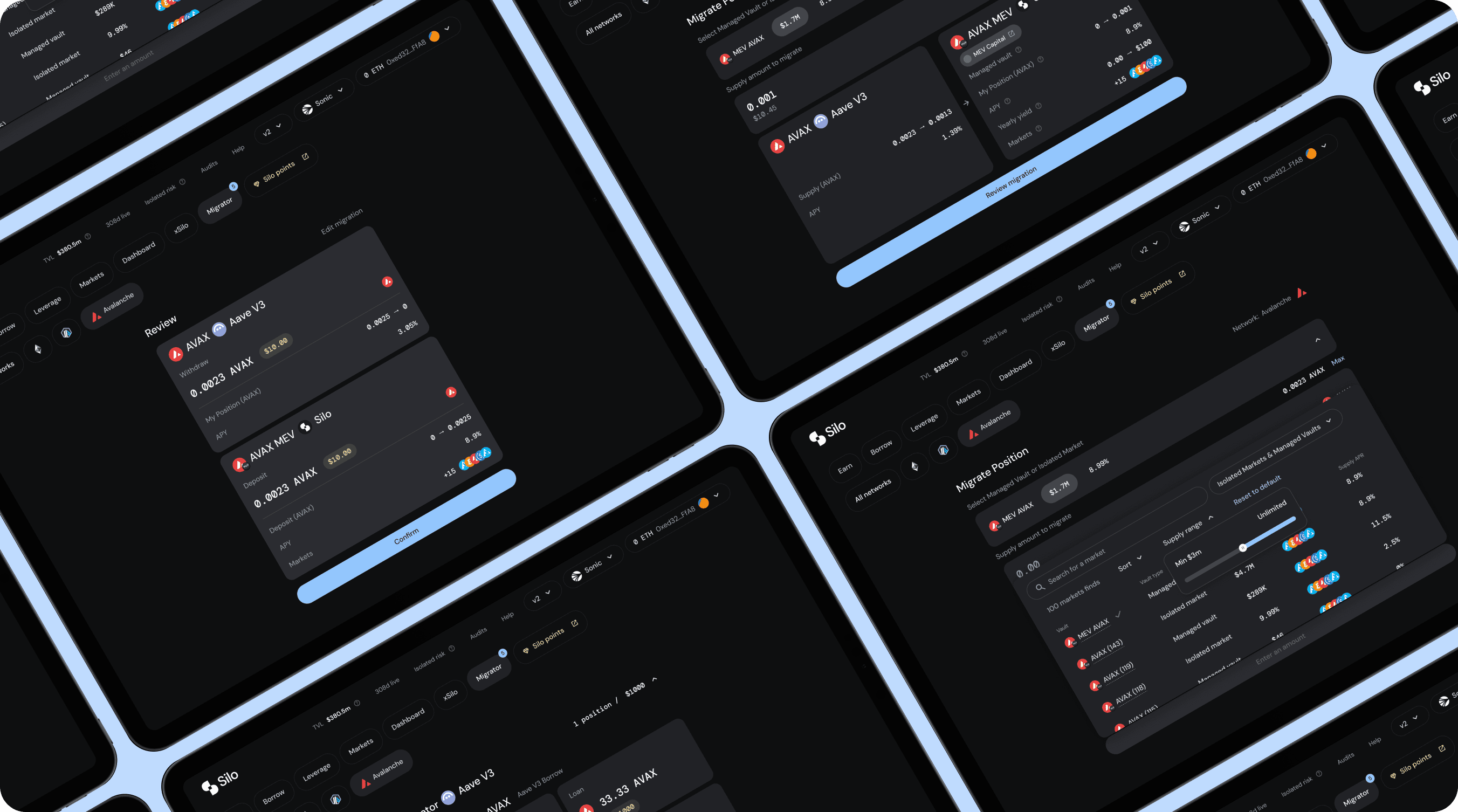

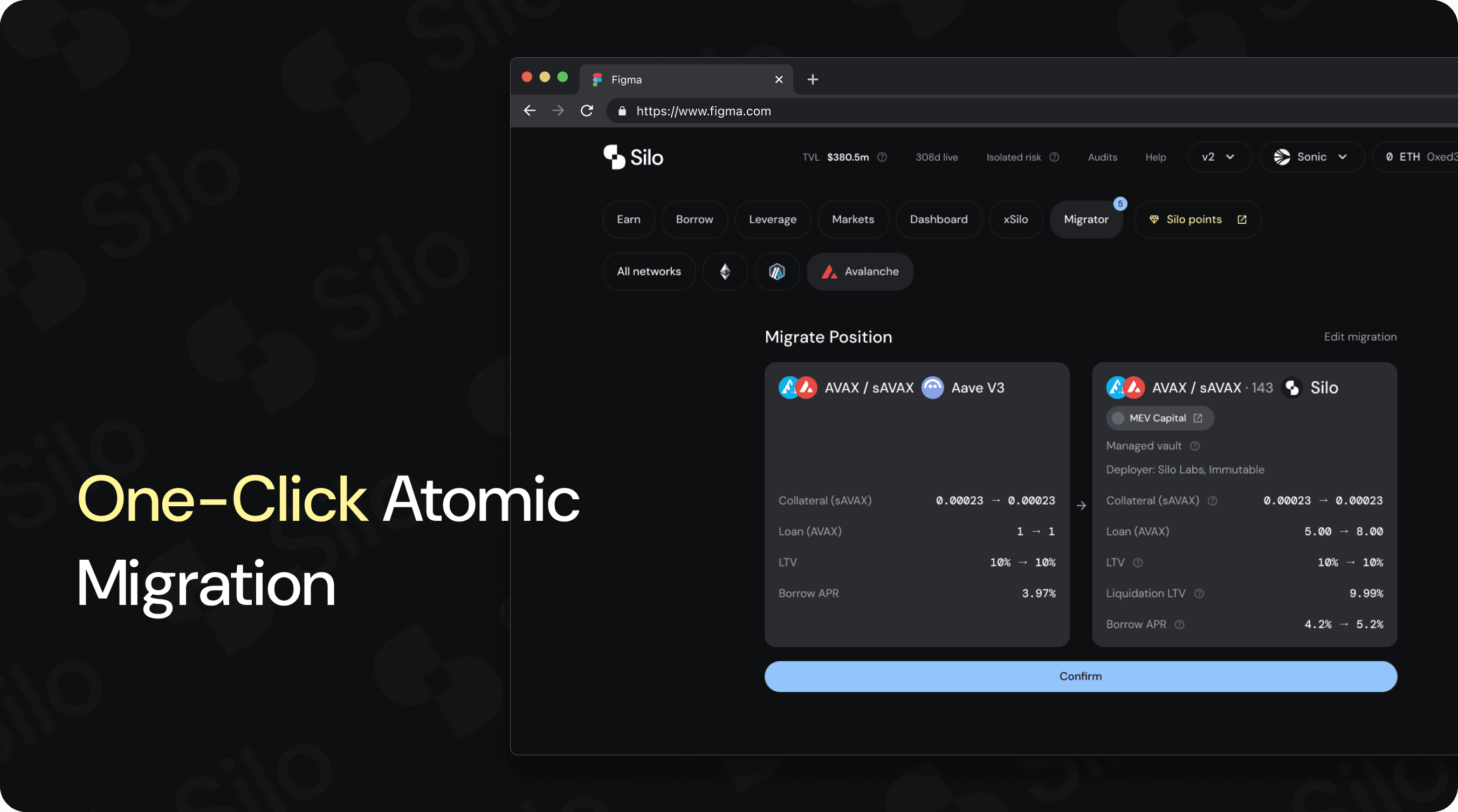

The Solution: One-Click Atomic Migration

Woof engineered an one-step Migrator that abstracts this complexity entirely and handles the whole process (withdraw collateral and open a new borrow position) instantly and safely in a single transaction.

The Technical Edge

We eliminated the need for users to hold the debt asset, reduced steps, and ensured maximum capital efficiency:

Flash Loan Architecture: The Migrator selects the best provider for a Flash Loan. This temporary loan is used to instantly repay the debt in the source protocol, allowing the collateral to be withdrawn immediately.

Atomic Safety: The entire flow (repay old debt, withdraw collateral, deposit collateral in Silo, open new debt, repay Flash Loan) occurs atomically—all within one transaction.

Best-Price Routing: Our solution integrates several flash loan protocols to ensure the user pays the absolute minimum fee to complete the migration, making some transfers virtually free.

Strategic Impact

Frictionless Acquisition: The Migrator removes the single biggest barrier to switching protocols, allowing Silo to efficiently acquire users and TVL from competitors.

Capital Optimization: Users can immediately earn higher APY or access better rates, converting their trapped capital into active, optimized TVL in Silo.

Zero Fees: No fees are taken by the Migrator itself, ensuring the incentive remains entirely on the user to optimize their position.

Protocols integrated: migration from AaveV3 and EulerV2, flashloans from AaveV3, EulerV2 and BalancerV3